Employers Should Benchmark PPE and CPE to Evaluate Employee Benefits Broker and Plan Performance

When evaluating their employee benefits broker, many employers focus on commission rates. Unfortunately, commission percentages are a poor—and sometimes misleading—measure of broker performance and plan value.

A far more effective place to start is by evaluating what you actually pay in total dollars given the size of your organization: Premium Per Employee (PPE) and broker Compensation Per Employee (CPE). These metrics provide a clearer, more accurate picture of plan cost, broker value, and fiduciary reasonableness.

The Commission Conundrum

Broker commission rates are calculated as commissions divided by premiums. Tying broker compensation directly to premium levels muddies the waters and can lead employers to the wrong conclusions about value. (It also creates a potential conflict of interest, but that’s a topic for another post.)

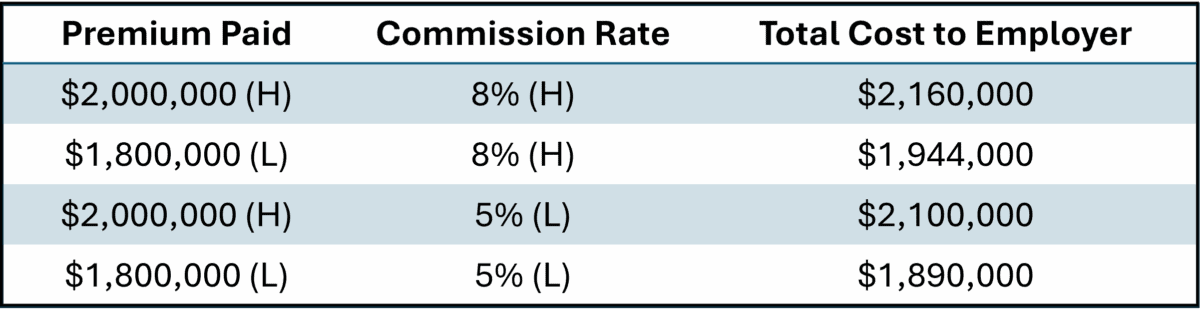

Consider the following scenarios:

High Commission | High Premium A high commission rate combined with high premiums relative to peer employers may indicate that the broker is taking excessive compensation while doing little to control plan costs. In this scenario, the employer is likely overpaying on both fronts and receiving poor overall value.

High Commission | Low Premium If, however, the commission rate is high and the premiums are low relative to peers, the broker may be working aggressively to negotiate favorable premiums and manage costs and be providing value-added services. In this case, the money saved on premiums often far exceeds the cost of high broker compensation, meaning the employer is getting good value from what the broker is earning.

Low Commission | High Premium If the commission rate is low and the premiums paid are high relative to peers, it could indicate that the broker is putting minimal effort into evaluating plans and negotiating with carriers and simply passing the costs along to the employer. Again, since premiums cost employers far more than broker compensation, this scenario often reflects poor value despite “low” broker commissions.

Low Commission | Low Premium A low commission rate and low premiums relative to peers reflects a broker that is working to keep both plan costs and broker costs low for the employer. This is the sweet spot of maximum broker value.

Next in Part 2: A better way for employers to assess broker value is by looking at Premium Per Employee (PPE) and broker Compensation Per Employee (CPE).